Forex Day Trading Strategies: Maximizing Your Profits

Day trading in the foreign exchange (Forex) market is a lucrative but challenging endeavor. It requires keen analytical skills, a solid understanding of market dynamics, and well-defined strategies. Whether you are a novice or an experienced trader, mastering effective strategies can significantly increase your chances of success. In this article, we will explore various Forex day trading strategies and provide insights into their implementation. Additionally, for those interested in trading in Saudi Arabia, forex day trading strategies Best Saudi Brokers can facilitate your trading journey.

Understanding Day Trading

Day trading involves buying and selling financial instruments within the same trading day. In Forex, this means opening and closing positions before the market closes, aiming to profit from small price movements. Successful day traders excel in quick decision-making, discipline, and effective risk management. Understanding Forex market trends and would-be triggers for price movements is also crucial for day traders.

Key Forex Day Trading Strategies

1. Scalping

Scalping is a high-speed trading strategy that involves making numerous trades throughout the day to capitalize on small price changes. Scalpers typically hold positions for seconds to minutes, requiring a fast trading platform and market depth analysis. A successful scalper must focus on technical analysis, observing trends, and using charts to identify potential entry and exit points quickly.

2. Momentum Trading

Momentum trading involves catching strong price movements in the market. Traders using this strategy look for currencies that are exhibiting significant volatility and are often influenced by news events or economic indicators. By using indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), traders can identify the momentum of a currency pair and enter trades accordingly. The key to success in momentum trading is ensuring you enter the trend early and exit before it reverses.

3. Breakout Trading

Breakout trading focuses on identifying price levels where a currency pair typically consolidates before a strong move occurs. Traders set buy orders above resistance or sell orders below support levels. When the price breaks through these levels, it often signifies a continuation of the trend. Effective breakout trading relies heavily on volume and momentum indicators, as these can help validate the move and signal that a trend might continue.

4. Range Trading

Range trading is based on the idea that prices often move within a predictable range for a given time. Traders utilizing this strategy identify support and resistance levels and make trades based on these boundaries. When the price approaches the support level, traders look to purchase, and conversely, when it gets close to the resistance, they might sell. This strategy requires an understanding of market behavior over various time frames and should be accompanied by strong risk management techniques.

5. News Trading

News trading capitalizes on increased volatility surrounding important economic news releases. Forex markets can react significantly to economic indicators such as unemployment rates, interest rate changes, and GDP reports. Traders who employ news trading strategies must stay updated on economic calendars and sentiment, preparing for the potential market reactions that can create trading opportunities. Timing is crucial, as entering too early can expose you to volatility bounce backs that may result in losses.

Essential Tools and Indicators for Day Traders

Beyond strategies, several tools and indicators can aid day traders in making informed decisions:

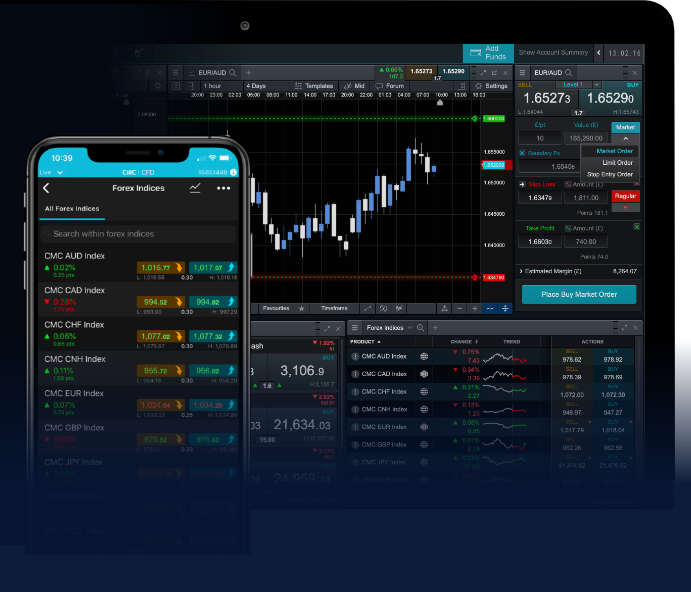

- Technical Analysis Software: Platforms such as MetaTrader, TradingView, or various broker platforms provide advanced charting tools, indicators, and drawing capabilities that are instrumental for day traders.

- Economic News Calendars: Staying informed about upcoming economic releases is vital. Websites like Forex Factory or Investing.com offer real-time updates and forecasts on economic events.

- Risk Management Tools: Stop-loss orders help to protect your capital by automatically closing a position at a predetermined price. Setting realistic take-profit levels is equally essential to safeguard gains.

Managing Your Risks

Effective risk management is critical in day trading. One common approach is to determine your risk tolerance for each trade, which is generally a small percentage of your trading account (commonly ranging from 1% to 2%). Always employ stop-loss orders and ensure that your potential reward outweighs your risks. A good guideline is to aim for a risk-reward ratio of at least 1:2. This means that for every dollar you risk, you should seek to gain at least two dollars.

Conclusion

In conclusion, forex day trading can be an exciting venture if approached with the right strategies and mindset. Scalping, momentum trading, breakout trading, range trading, and news trading offer various methods to capitalize on market movements. As you develop and refine your trading strategies, remember to prioritize risk management and remain disciplined in your trading approach. Staying updated with the latest market information and continuously educating yourself will also greatly enhance your trading performance.

Happy trading!